Meta Unveils Affordable $299 Quest 3S VR Headset and Orion AR Glasses Prototype

Hardware

Zaker Adham

25 September 2024

25 September 2024

|

Zaker Adham

Summary

Summary

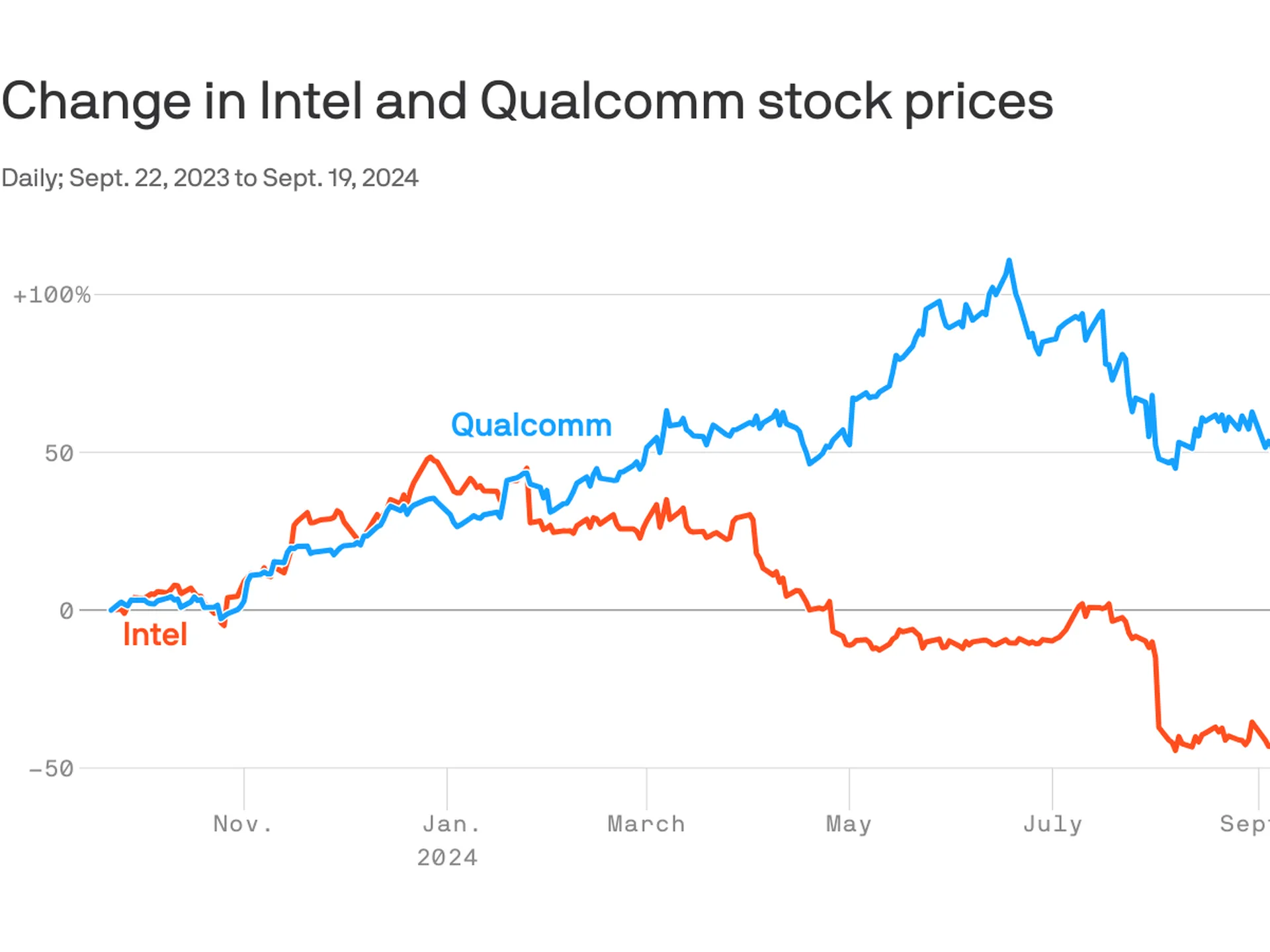

Equity analysts are expressing doubts about the potential merger between Qualcomm Inc. and Intel Corp. following reports that Qualcomm has approached Intel regarding a takeover. The concerns were notably echoed by Dave Novosel, a credit analyst from Gimme Credit, who pointed out that such a deal could push Qualcomm’s debt into junk-bond territory.

Currently, Qualcomm has over $14 billion in outstanding bonds that are rated A by S&P Global Ratings, as reported by FactSet. On the other hand, Intel holds more than $50 billion worth of bonds rated at BBB+, which recently faced a downgrade due to pessimistic growth forecasts and margin pressures.

Novosel highlighted that financing a significant equity component in the acquisition would likely lead to considerable dilution for Qualcomm's shareholders. A downgrade to junk status could also raise Qualcomm’s borrowing costs and exclude it from investment opportunities available to institutional investors, such as pension funds that typically avoid junk-rated securities.

He has initiated an underperform rating on Qualcomm's bonds, mentioning that its 2033 notes are trading at a yield spread of 50 basis points over Treasuries. While he expressed skepticism about the likelihood of Qualcomm completing an Intel acquisition, he noted the potential benefits of such a deal, particularly in diversifying Qualcomm’s reliance on its Apple business, which currently accounts for over 70% of its revenue.

Intel has not provided comments regarding the rumors of a potential takeover, and Qualcomm has not responded to inquiries from MarketWatch. Novosel acknowledged some advantages of acquiring Intel, particularly its capabilities in PCs and data center servers, which could enhance Qualcomm's existing smartphone business. He stated that the merger could lead to meaningful revenue and cost synergies, especially in administrative areas.

However, the recent drop in Intel's stock value—down 52% year-to-date—has reduced its market capitalization to about half that of Qualcomm. Novosel estimates that any acquisition bid would likely exceed $100 billion, requiring substantial amounts of both debt and equity.

Intel’s current high leverage, resulting from its investments in expanding fabrication facilities, coupled with declining revenues and operational losses in its foundry business, has negatively impacted its earnings before interest, taxes, depreciation, and amortization (EBITDA). This metric is critical for assessing a company's ability to manage its interest obligations.

Novosel warned that acquiring Intel could severely impact Qualcomm’s profit margins, as Intel has recorded negative operating income in eight of its last nine quarters due to product ramp-up challenges. While he suggests that Intel’s financial struggles may soon improve, the incorporation of Intel’s operations could turn Qualcomm's free cash flow negative due to high capital expenditures.

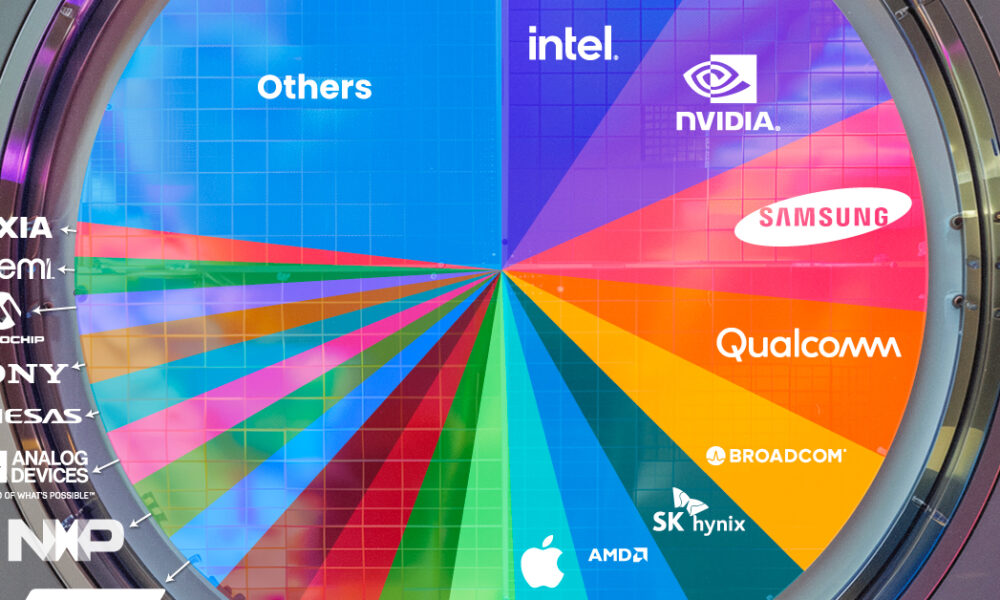

Despite these potential drawbacks, analysts do not anticipate Qualcomm showing much interest in Intel’s foundry operations, given its reliance on external chip manufacturers such as Taiwan Semiconductor and Samsung. However, divesting this unit amidst significant losses poses its own set of challenges, especially considering the scrutiny from U.S. regulators regarding Intel’s government subsidies aimed at enhancing domestic chip production.

Analysts suggest that Qualcomm might be better off targeting specific segments within Intel rather than pursuing a full acquisition, though this strategy would require careful consideration as the most promising units are integral to Intel’s growth strategy.

In the bond market, reactions to the takeover discussions have been mixed. Despite the Wall Street Journal report, both Qualcomm and Intel have seen net buying, with Intel attracting more interest due to its higher liquidity. Although credit spreads have tightened, this trend reflects broader market conditions rather than enthusiasm for the potential merger.

As of now, Qualcomm's stock has dipped by 4% in the current month, while Intel's stock has risen by 16%.

Hardware

Zaker Adham

25 September 2024

Hardware

Paikan Begzad

18 September 2024

Hardware

Paikan Begzad

14 September 2024

Hardware

Paikan Begzad

13 September 2024