BEL Shares Drop 3% Despite Ministry Approval for JV with Israel Aerospace Industries

Finance

Zaker Adham

30 September 2024

02 October 2024

|

Zaker Adham

Summary

Summary

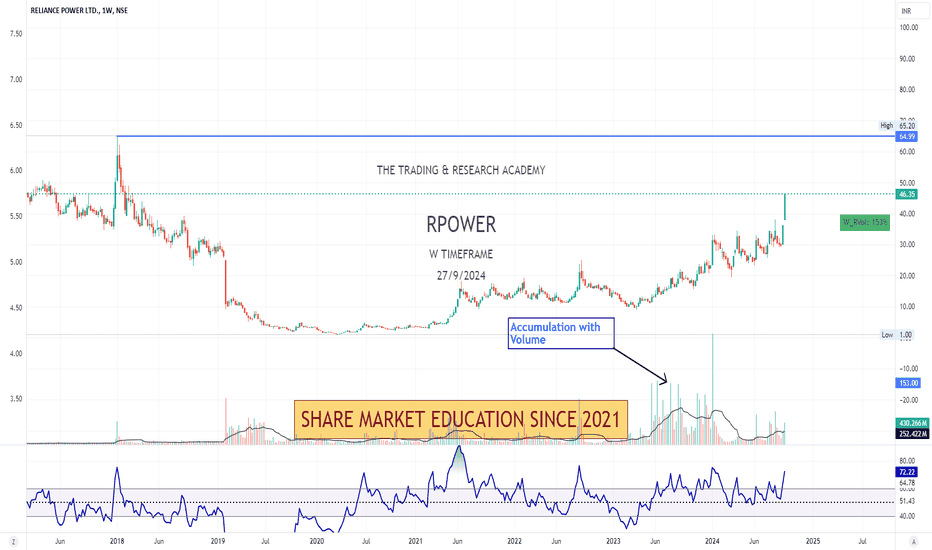

Reliance Power (RPower) shares have continued their remarkable rally, reaching a fresh 52-week high of ₹51.10, climbing 5% on Tuesday. This multibagger stock has seen impressive growth, delivering a 61.69% rise in just a month and surging 113.36% so far in 2024.

The stock's recent performance has triggered its placement under the Additional Surveillance Measure (ASM) framework by both the BSE and NSE due to heightened volatility. This move serves as a caution for investors amid rapid price fluctuations.

RPower, part of the Anil Ambani-led Reliance Group, has scheduled a board meeting on October 3 to discuss raising long-term capital through equity shares or securities convertible into equity.

What Analysts Are Saying: Despite the stock's strong performance, some analysts are advising caution. Shiju Koothupalakkal, Technical Research Analyst at Prabhudas Lilladher, commented, "RPower has surged to the ₹51 zone in the last three weeks. It may still have room to move upward towards ₹54 and ₹59 in the coming days, but profit booking is possible at this stage. If it falls below the ₹44 level, the trend could weaken, and we might see a drop towards ₹35."

Jigar S Patel, Senior Manager - Technical Research Analyst at Anand Rathi, highlighted key levels: “Support is at ₹48, and resistance is at ₹52. A close above ₹52 could push the stock further to ₹55, with the short-term trading range expected to be between ₹48 and ₹56.”

Ravi Singh, Senior Vice-President (Retail Research) at Religare Broking, warned, "Investors should avoid entering at current levels due to an unfavorable risk-reward ratio. Those holding should consider booking profits."

Similarly, SEBI-registered analyst AR Ramachandran stated, "While the stock remains bullish, it's also overbought on daily charts. Resistance is at ₹52, and investors should take profits. A daily close below ₹43 could lead to a decline towards ₹35."

As of June 2024, promoters hold a 23.24% stake in the company.

Finance

Zaker Adham

30 September 2024

Finance

Zaker Adham

27 September 2024

Finance

Zaker Adham

27 September 2024

Finance

Zaker Adham

25 September 2024