AI

3 Top AI Stocks Primed for Growth

05 October 2024

|

Zaker Adham

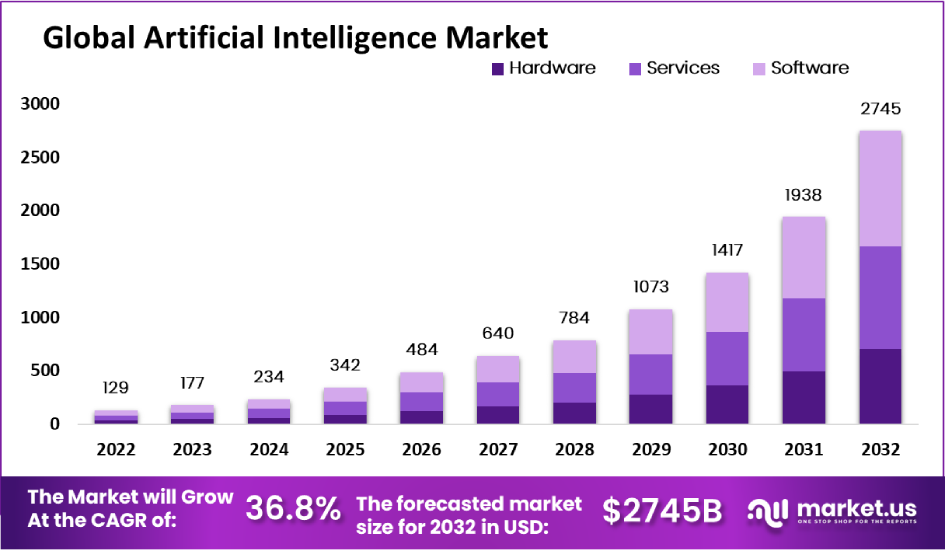

The explosive growth of artificial intelligence (AI) continues to fuel the tech sector, with companies like Nvidia (NASDAQ: NVDA) and Microsoft leading the charge. Nvidia supplies the high-performance GPUs crucial for AI applications, while Microsoft has integrated AI tools from OpenAI, including ChatGPT, into its expansive cloud offerings.

Nvidia’s stock has skyrocketed by 2,590% over the last five years as businesses seek to upgrade their systems. Microsoft’s stock has also more than tripled, benefiting from its investment in AI. While these industry giants remain solid long-term options, there are lesser-known companies poised for significant growth in the AI space. Here’s a closer look at three promising AI stocks: Oracle (NYSE: ORCL), Broadcom (NASDAQ: AVGO), and Arm Holdings (NASDAQ: ARM).

1. Oracle

Oracle, a global leader in database software, has transformed its business over the last decade, shifting its traditional on-premises software to cloud-based services. It has enhanced its offerings with enterprise resource planning (ERP) services and expanded its cloud infrastructure platform.

Oracle is well-positioned to benefit from AI's growth in two key areas: its database software processes large amounts of data for AI applications, and its cloud infrastructure supports the computational needs of these AI-powered technologies. Currently, 42% of Oracle's revenue comes from cloud-based services. In fiscal 2024, its infrastructure-as-a-service (IaaS) revenue surged by 50%, driven by the growing AI market, and is expected to accelerate further in fiscal 2025.

From fiscal 2024 to 2027, analysts project Oracle’s revenue will grow at a compound annual growth rate (CAGR) of 12%, while its earnings per share (EPS) could rise at a CAGR of 21%. With a price-to-earnings ratio of 31 times next year’s earnings, Oracle may seem expensive, but its strong cloud expansion justifies the valuation.

2. Broadcom

Broadcom, a semiconductor and infrastructure software giant, has grown through strategic acquisitions, adding companies like CA Technologies, Symantec’s enterprise security division, and VMware to its portfolio. This diversification allows Broadcom to play a significant role in the mobile, data center, networking, wireless, and storage markets.

The company’s AI-driven business has seen a sharp increase, with its revenue from AI-related networking and custom accelerator chips expected to triple to $12 billion in fiscal 2024. This rapid growth is offsetting slower sales in its non-AI segments.

Looking forward, Broadcom is expected to grow its revenue at a CAGR of 24% between fiscal 2024 and 2027, with an 18% increase in EPS. While its stock trades at 43 times next year’s earnings, this is primarily due to recent acquisitions. When adjusted, the valuation appears more reasonable at 27 times forward earnings, making it an attractive AI stock.

3. Arm Holdings

Arm Holdings, the U.K.-based chip designer, was acquired by SoftBank in 2016 and recently re-entered the public market via an IPO. Arm designs energy-efficient chips used by major companies such as Qualcomm, MediaTek, and Apple. Its designs power 99% of premium smartphones, although it’s expanding into the automotive, PC, and cloud markets.

Arm's latest designs, particularly the Armv9, are optimized for AI applications and command higher royalties than traditional chip designs. As Arm shifts more into AI, analysts expect its revenue to rise at a CAGR of 23% through fiscal 2027, with EPS increasing at a staggering CAGR of 88%.

Although Arm’s stock trades at over 100 times next year’s earnings, the potential for continued AI expansion and its role in displacing older chip architectures like x86 from Intel and AMD provide significant growth opportunities.

The Bottom Line

While major players like Nvidia and Microsoft dominate AI headlines, Oracle, Broadcom, and Arm Holdings represent three AI stocks that could see significant growth as the AI sector continues to expand. Investors looking for more opportunities in AI should keep an eye on these companies as they develop their presence in this booming industry.