China Stocks See Best Trading Day Since 2008 Amid Stimulus Surge

Stocks

Zaker Adham

30 September 2024

27 September 2024

|

Zaker Adham

Summary

Summary

In a surprising turn of events, Alibaba Group Holding Ltd., JD.com Inc., and Meituan have recorded their most substantial trading days in years, propelled by the Chinese government's announcement of economic stimulus measures aimed at revitalizing the struggling domestic economy. A buying frenzy swept through consumer tech firms and other sectors, fueled by optimism that Beijing’s comprehensive policy changes will yield positive results.

Both Meituan and JD.com saw their stock prices surge by over 20% in Hong Kong trading over the course of Thursday and Friday, marking their best two-day performance since 2022. Alibaba also enjoyed a robust increase, climbing by as much as 15% during the same period.

The Chinese government's stimulus package came as a welcome surprise, featuring extensive support for the struggling property sector, direct cash payments to residents facing economic challenges, and enhanced social security benefits for unemployed graduates. These measures helped alleviate concerns regarding the debt-laden property market and the soaring youth unemployment rate, boosting confidence in consumer and internet sectors.

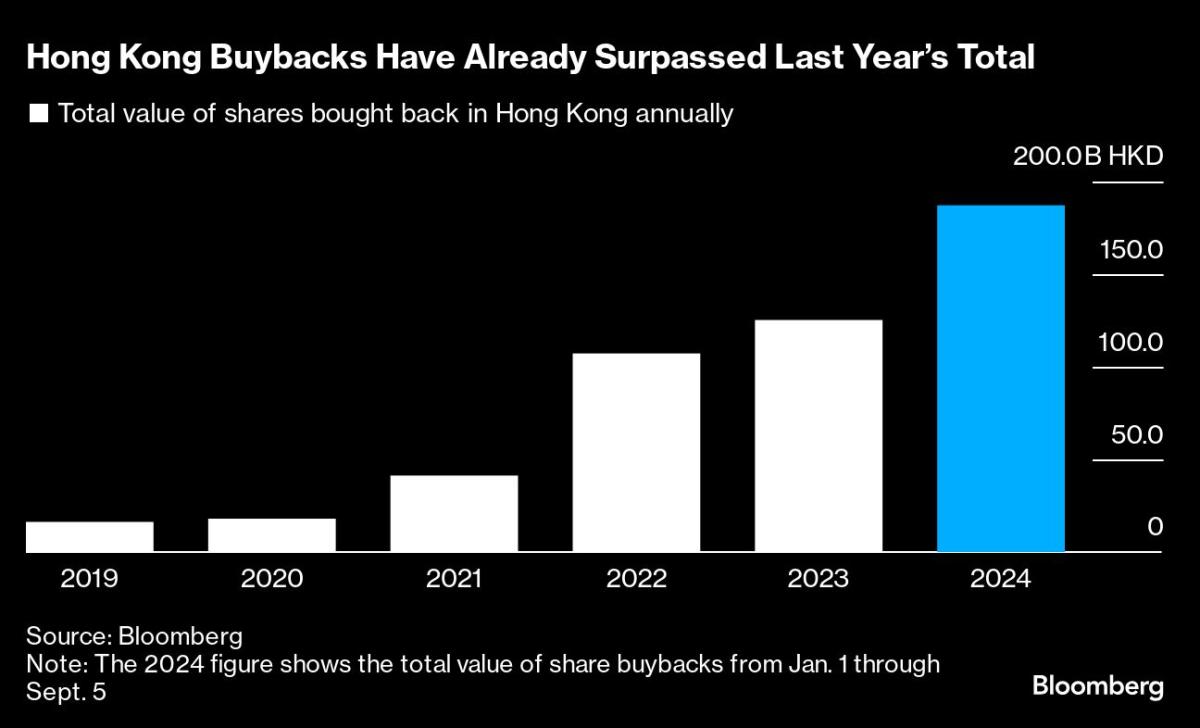

Cash-rich tech companies, including Alibaba from Hangzhou, are at the forefront of a renewed push for share buybacks on the Hong Kong market this year. Notably, returns from China’s leading tech stocks are outpacing their global counterparts, with Alibaba boasting a shareholder yield of over 8% at the beginning of this month—more than double that of any firm in the US's Magnificent Seven. Prior to this week, these buybacks had primarily served as a defensive strategy to counter declining stock prices amid persistent worries about economic sluggishness. However, in light of the new announcements from Beijing, this buyback momentum is rekindling interest in China’s beleaguered tech sector.

According to Bloomberg Economics, alongside the People's Bank of China's unexpected stimulus announcement on Tuesday and a strong commitment from the Politburo to employ fiscal and monetary measures for growth, these programs indicate that policymakers are increasingly serious about reviving economic recovery, stabilizing employment, and ensuring social stability. Given the escalating policy momentum, further support measures are likely, especially those targeting job market stabilization and boosting consumer demand.

Stocks

Zaker Adham

30 September 2024

Stocks

Zaker Adham

30 September 2024

Stocks

Zaker Adham

30 September 2024

Stocks

Zaker Adham

26 September 2024