Metal Stocks Rally as NMDC Leads Gains Amid Rising Iron Ore Prices and China's Economic Stimulus

Stocks

Zaker Adham

30 September 2024

30 September 2024

|

Zaker Adham

Summary

Summary

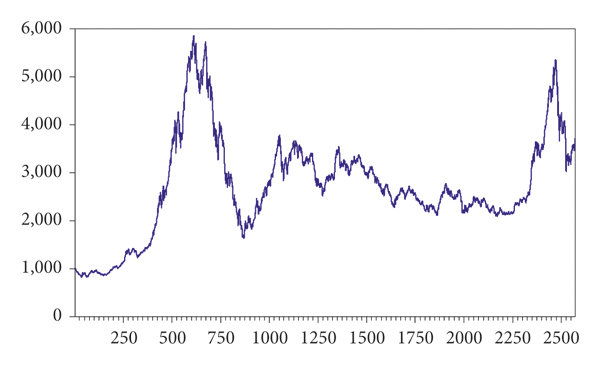

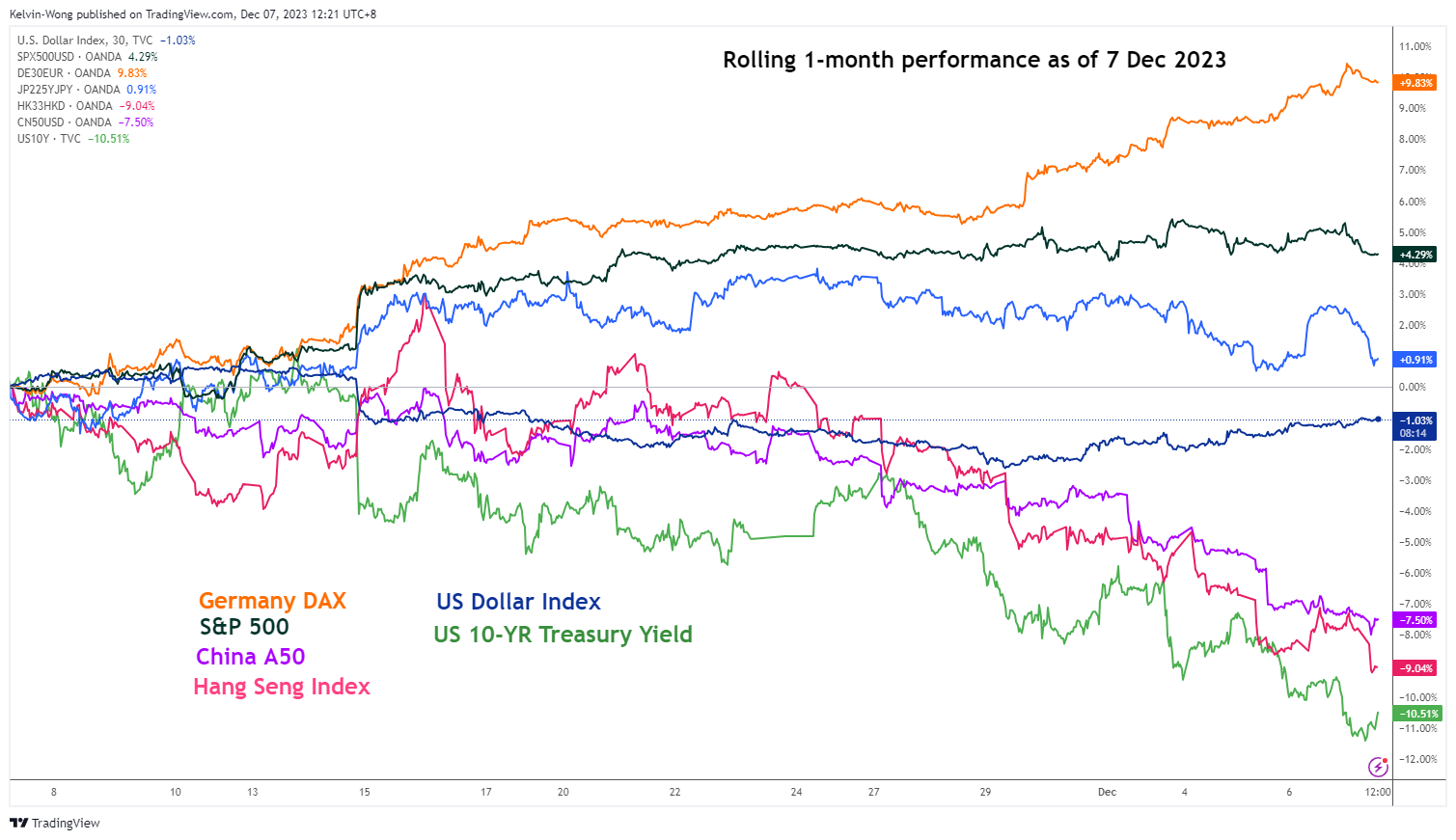

China's stock market had its most significant trading day in 16 years, with the CSI 300 index soaring 8.48%, driven by gains in healthcare and technology stocks, closing at 4,017.85. This marks a remarkable nine-day winning streak and the highest level for the index since August 2023.

The rally comes as China's economy continues to benefit from recent government stimulus measures. These include efforts to boost the property market and other sectors, with investor confidence surging as a result. The official purchasing managers' index (PMI) for September showed a reading of 49.8, slightly better than the expected 49.5, but still indicating a fifth consecutive month of contraction in the manufacturing sector.

In contrast, the Caixin PMI—a private survey compiled by S&P Global—fell to 49.3, showing a sharper decline than anticipated. This represents the steepest drop in manufacturing activity in over a year.

Elsewhere, Hong Kong's Hang Seng Index climbed by 3.09%, driven by strong performances from consumer stocks. The Hang Seng Mainland Properties Index jumped 8.11%, contributing to overall market optimism.

Meanwhile, Japan's Nikkei 225 index experienced a sharp decline of 4.8% as investors reacted to economic data and the results of the Liberal Democratic Party election. The index closed at 37,919.55, with significant losses in real estate stocks. Isetan Mitsukoshi Holdings, a department store company, saw its stock drop by over 10%. Japan's industrial production in August dropped 4.9% year-on-year, further weighing on market sentiment.

The Japanese yen also weakened against the dollar, falling by 0.13% to 142.38, as traders assessed the impact of the country’s recent political and economic developments.

In other Asian markets, Australia’s S&P/ASX 200 index rose 0.7% to reach a new all-time closing high, while South Korea’s Kospi fell by 2.13%, closing at 2,593.27.

Over in the U.S., the Dow Jones Industrial Average hit a new high on Friday, gaining 0.33% to end at 42,313.00, as traders evaluated new data showing progress on inflation control.

Stocks

Zaker Adham

30 September 2024

Stocks

Zaker Adham

30 September 2024

Stocks

Zaker Adham

27 September 2024

Stocks

Zaker Adham

26 September 2024