Morgan Stanley Downgrades GM Stock Due to China Competition and AI Costs

Business Intelligence (BI)

Zaker Adham

25 September 2024

04 October 2024

|

Zaker Adham

Summary

Summary

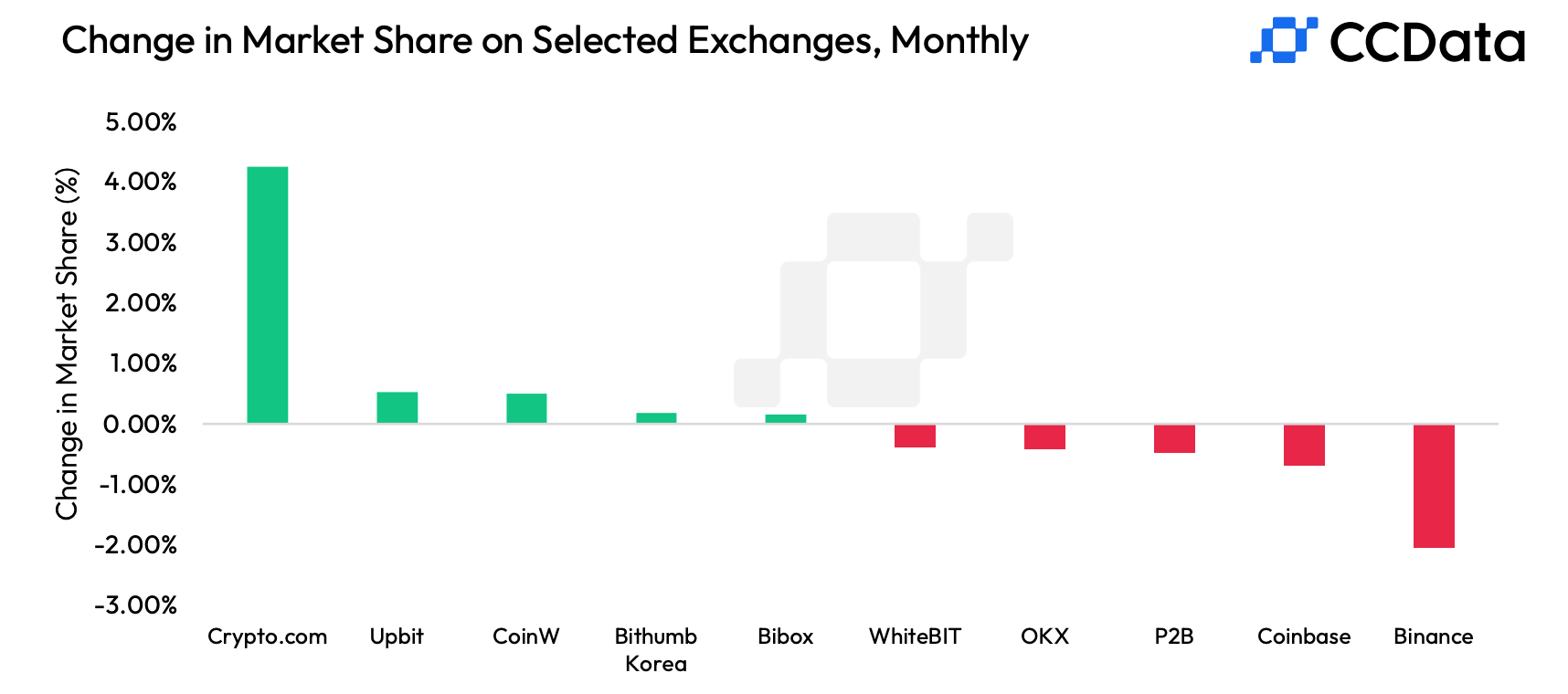

In September, Binance, one of the world’s largest cryptocurrency exchanges, experienced a notable drop in trading activity. According to a recent report by CCData, the exchange’s derivatives trading volume fell by 21% to $1.25 trillion, marking the lowest figure since October 2023. This downturn caused Binance’s share of the derivatives market to shrink to 40.7%, a level not seen since September 2020.

Binance’s spot trading volume also faced a significant decline, plunging by 22.9% to $344 billion — the lowest monthly figure since November 2023. This decline reduced the exchange’s market share in spot trading to 27%, the smallest since January 2021. When combining both spot and derivatives trading, Binance’s overall market share fell to 36.6%, its lowest point since 2020.

Despite this setback, Binance remains the leader in global spot trading volume among centralized exchanges (CEX). However, the downturn in trading activity is not unique to Binance. The broader market for centralized exchanges mirrored this trend, with overall trading volume for spot and derivatives falling by 17% in September to $4.34 trillion, the lowest monthly total since June.

Interestingly, as Binance faced declines, Crypto.com, another major exchange, saw impressive growth. Crypto.com’s spot and derivatives trading volumes surged by 40.2% and 42.8%, respectively, to $134 billion and $149 billion. This expansion pushed Crypto.com’s market share to 11%, making it the fourth-largest exchange by volume.

CCData analysts attributed the overall decline to historical seasonal trends, which often see lower trading volumes during the late summer months. However, analysts are optimistic about a rebound, pointing to potential catalysts such as the U.S. Federal Reserve’s anticipated interest rate cuts. The Fed's actions could enhance liquidity and capital flow into riskier assets, including cryptocurrencies, driving a resurgence in trading activity.

“The decline in activity coincides with seasonal trends, but catalysts like the Federal Reserve’s first interest rate cut since March 2020 are expected to drive the next phase of growth,” the report concluded.

Business Intelligence (BI)

Zaker Adham

25 September 2024

Business Intelligence (BI)

Zaker Adham

25 September 2024

Business Intelligence (BI)

Zaker Adham

12 September 2024

Business Intelligence (BI)

Paikan Begzad

09 September 2024