Binance Derivatives Market Share Drops to 2020 Levels Amid CEX Trading Slowdown

Business Intelligence (BI)

Zaker Adham

04 October 2024

25 September 2024

|

Zaker Adham

Summary

Summary

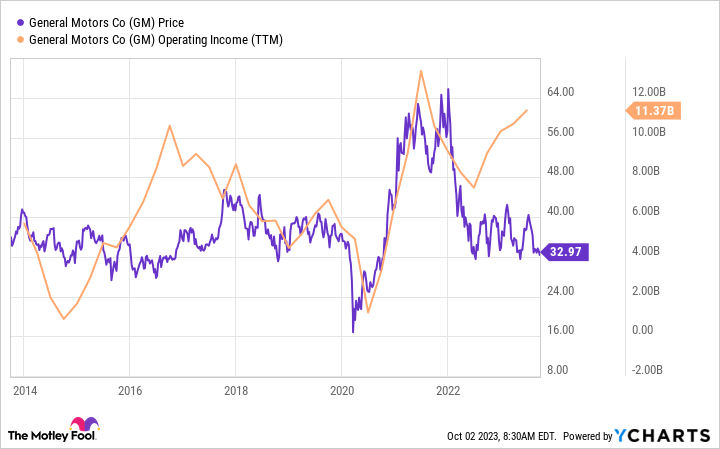

General Motors (GM) saw its stock downgraded by Morgan Stanley analyst Adam Jonas on Wednesday, as concerns about China’s growing vehicle surplus and rising competition weighed heavily on the automaker's outlook. Jonas cut GM’s rating from "equal weight" to "underweight," citing the increasing risks from China, which now produces 9 million more vehicles annually than it sells. What once was a profit center has now turned into a competitive threat for GM.

In addition to the challenges from China, Jonas highlighted rising vehicle inventories, shifting consumer credit dynamics, and the rising costs associated with integrating artificial intelligence into vehicles as key factors behind the downgrade.

This comes as Tesla's (TSLA) rival, China-based BYD (BYDDF), continues to perform strongly, flashing a buy signal. Meanwhile, Tesla is generating industry buzz with the upcoming unveiling of its robotaxi plans on October 10.

Following the downgrade, GM, Ford (F), and Rivian (RIVN) all experienced a slump in Wednesday’s stock market session. GM was hit the hardest, with its stock falling 4% to $46.12, while Rivian dropped 3.5% and Ford declined 2.2%. Despite the gloomy outlook for automakers, Jonas remained optimistic about auto retailers like AutoNation (AN) and CarMax (KMX), which could benefit from lower auto loan rates if the Federal Reserve cuts interest rates.

Jonas also slashed GM’s price target to $42, down from $47, a figure below Tuesday’s closing price. Rivian and Ford also saw their price targets lowered, from $16 to $13 and from $12 to $10, respectively. He projected that both GM and Ford will gradually lose market share as they face intensifying competition. Additionally, Rivian’s capital expenditures are expected to rise by $300 million annually, driven by the high costs of developing autonomous driving technology and advanced driver-assistance systems.

While GM and Ford faced downgrades, Morgan Stanley kept its "overweight" rating for both Tesla and Ferrari (RACE), signaling confidence in their continued growth and market position.

GM’s stock had rallied more than 80% since hitting lows last November, recovering from challenges that included labor strikes and EV production delays. GM also resumed its Cruise robotaxi services after a pedestrian accident had caused a brief pause. However, the stock's recovery might be facing new hurdles, as the company anticipates further declines in auto prices, forecasting a 1% to 1.5% dip in the second half of the year.

Business Intelligence (BI)

Zaker Adham

04 October 2024

Business Intelligence (BI)

Zaker Adham

25 September 2024

Business Intelligence (BI)

Zaker Adham

12 September 2024

Business Intelligence (BI)

Paikan Begzad

09 September 2024