Unprecedented Bidding War Erupts Over Anysphere, Creator of Popular AI Coding Assistant Cursor

Technology News

Zaker Adham

09 November 2024

01 October 2024

|

Zaker Adham

Summary

Summary

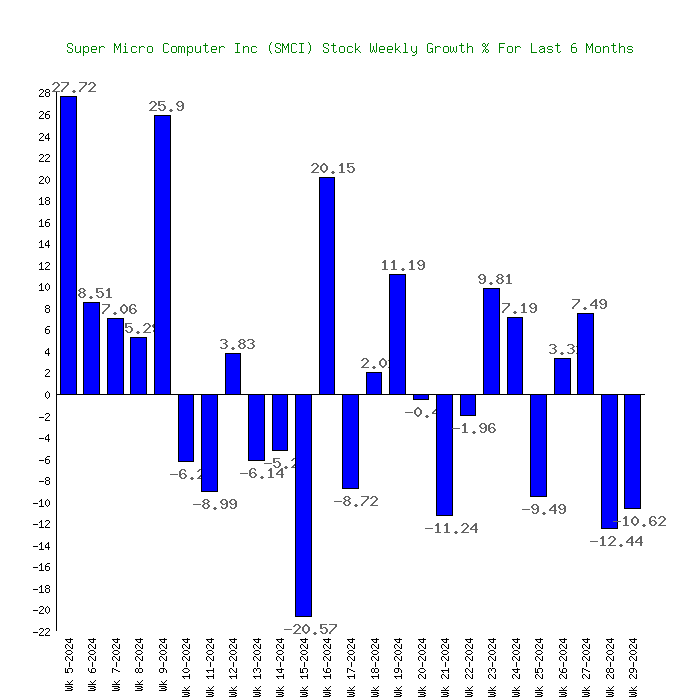

Super Micro Computer (NASDAQ: SMCI), often referred to as Supermicro, has faced turbulence in recent months. In March 2024, its stock hit a record high of $1,188.07, giving the company a market cap of $67 billion. This marked a staggering 5,080% gain over the previous four years, driven largely by the company's success in selling high-performance servers to the fast-growing AI market.

However, the stock has since taken a dramatic dive. Currently trading at around $420, Supermicro's market cap has dropped to $25 billion, with concerns surrounding declining margins, short-seller claims, delayed filings, and possible scrutiny by the U.S. Department of Justice (DOJ). This 65% loss has left investors wondering if Supermicro can rebound and potentially become a trillion-dollar company by 2030.

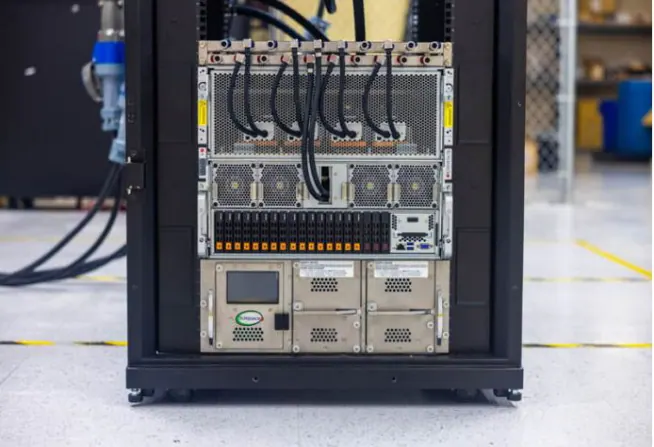

What Sparked Supermicro's Rise? Supermicro earned its reputation by offering high-performance liquid-cooled servers, becoming a preferred partner for Nvidia, which provided the company with top-tier GPUs. Although its market share is smaller compared to giants like Dell Technologies and Hewlett Packard Enterprise (HPE), Supermicro’s sales of AI-focused servers surged as businesses upgraded their data centers to accommodate AI applications.

Between fiscal 2020 and fiscal 2024, Supermicro’s revenue grew at a compound annual growth rate (CAGR) of 45%, while its adjusted earnings per share (EPS) climbed by 68% annually. Over half of its revenue now comes from AI-specific servers, and analysts at Bank of America expect the company to grow its share of this niche from 10% to 17% within the next three years.

Why Did Supermicro's Stock Fall? Despite its early success, Supermicro’s AI server margins are lower than those of its other server lines, contributing to a decline in its gross margins. From fiscal 2020 to fiscal 2024, the company’s gross margin fell from 15.9% to 14.2%. Compounding this, competitors like Dell and HPE have ramped up production of high-performance servers, pressuring Supermicro to keep up while maintaining profitability.

In August 2024, Hindenburg Research, known for short-selling, accused Supermicro of inflating revenues, causing further uncertainty. Supermicro denied these claims but delayed its annual report filing, citing the need for more time to review its financial reporting controls. Rumors of a DOJ investigation, as reported by The Wall Street Journal, further weighed on the stock, although the DOJ has not confirmed any probe.

Supermicro has faced regulatory issues in the past. The company was delisted from the Nasdaq in 2018 due to accounting irregularities, only to be reinstated in 2020 after settling with the U.S. Securities and Exchange Commission (SEC). These lingering concerns continue to cast doubt over its future.

Where Will Supermicro Be in 2030? Despite these challenges, many analysts remain optimistic about Supermicro's growth potential. Wall Street projections estimate that from fiscal 2024 to fiscal 2026, Supermicro’s revenue will grow at a CAGR of 46%, with EPS rising at a CAGR of 39%.

If Supermicro can maintain a 25% annual growth rate in EPS from fiscal 2026 to fiscal 2030, its stock could rise by approximately 465%, pushing its market cap to $134 billion. While this is an impressive leap, it falls short of the trillion-dollar mark. To reach such heights, the company will need to resolve its regulatory issues, protect its margins, and fend off increasing competition.

Investors should focus less on whether Supermicro will join the trillion-dollar club and more on whether it can stabilize its financials and navigate short-seller claims. Without addressing these challenges, its stock may struggle to keep up with competitors like Dell and HPE.

Technology News

Zaker Adham

09 November 2024

Technology News

Zaker Adham

09 November 2024

Technology News

Zaker Adham

09 November 2024

Technology News

Zaker Adham

07 November 2024