Unprecedented Bidding War Erupts Over Anysphere, Creator of Popular AI Coding Assistant Cursor

Technology News

Zaker Adham

09 November 2024

15 September 2024

|

Zaker Adham

Summary

Summary

The UK's Competition and Markets Authority (CMA) has raised provisional concerns about the proposed merger between Vodafone and Three, suggesting it could lead to higher prices and reduced services for millions of mobile customers.

An independent inquiry group has tentatively concluded that the merger might result in increased costs for consumers or smaller data packages in contracts. Stuart McIntosh, chair of the inquiry group, stated, "We have thoroughly investigated this merger, balancing the companies' promised investments in network quality and 5G connectivity against the potential costs to customers and rival networks."

While the CMA acknowledges potential improvements in mobile network quality and faster 5G deployment, it currently views these benefits as overstated. This skepticism poses a significant challenge for Vodafone and Three, who argue that their merger is essential for enhancing the UK's mobile infrastructure.

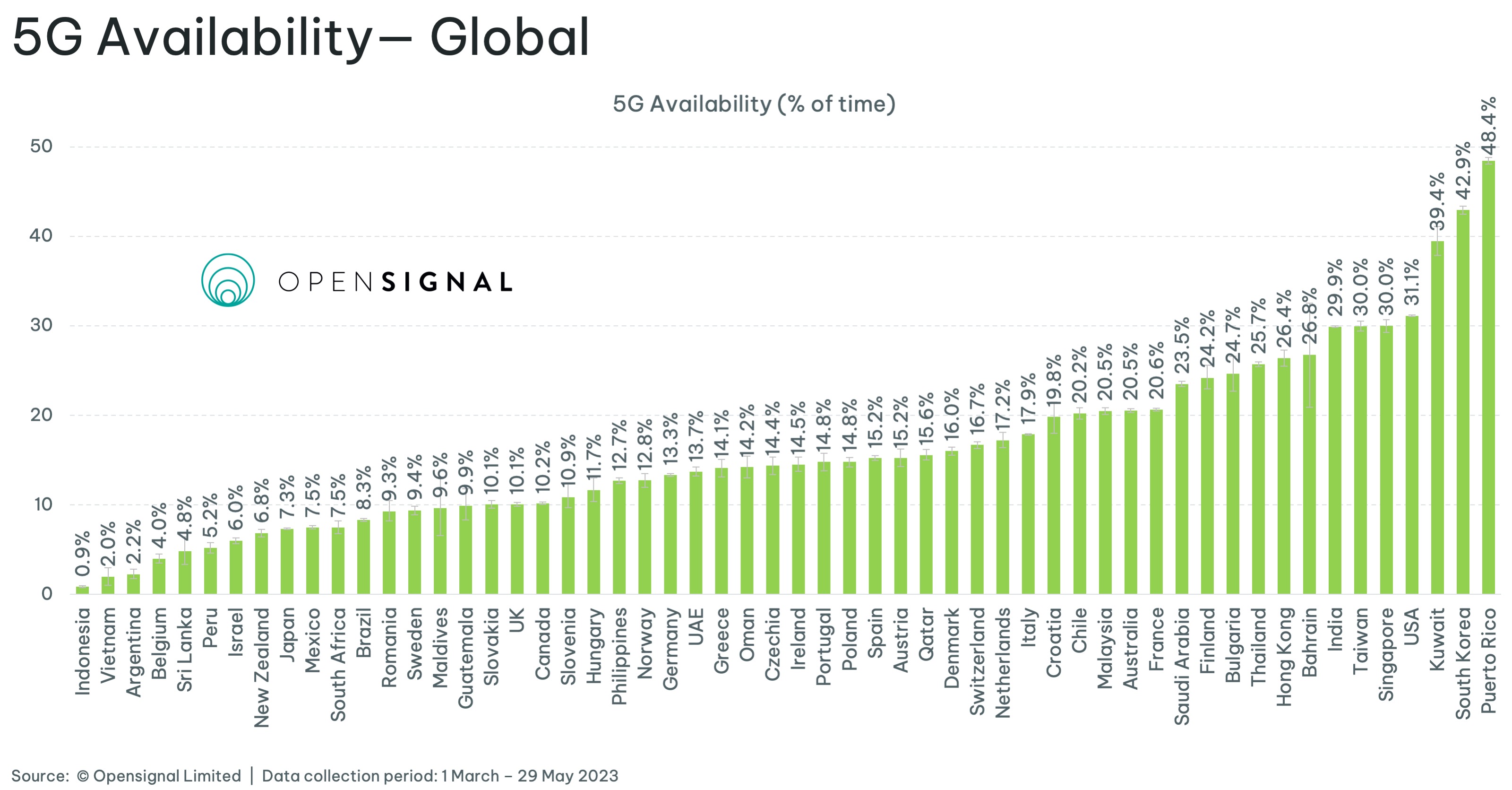

In response, Vodafone and Three have jointly stated that their merger will address the UK's "dysfunctional mobile market," promoting more competition and investment. They reference Opensignal analysis showing the UK ranks 22nd out of 25 European countries for 5G availability and speed, with the slowest data speeds among the G7.

Margherita Della Valle, CEO of Vodafone, emphasized, "Our merger is a catalyst for change. It's time to remove the barriers to the country's connectivity and build the world-class infrastructure it deserves."

Is This the End for the Vodafone-Three Merger?

The CMA's provisional objection has sparked a debate between regulatory caution and industry ambitions for improved infrastructure. Despite the concerns, industry analysts see potential paths forward.

Kester Mann, Director of Consumer and Connectivity at CCS Insight, noted, "The CMA offers a potential path to approval through various remedies. Importantly, it seems open to considering 'behavioral remedies' such as enhanced network access for virtual providers or safeguards for retail customers."

The CMA has provisionally concluded that the merger would significantly lessen competition in both retail and wholesale mobile markets in the UK. It will now consult on its provisional findings and potential solutions, including legally binding investment commitments overseen by the sector regulator.

The CMA is welcoming responses to its provisional findings by October 4, 2024, and its notice of possible remedies by September 27, 2024. These responses will be considered before the CMA issues its final report, due by December 7, 2024.

"The next three months could be pivotal for the UK telecoms sector," Mann emphasized. He believes that approving the merger would be the best outcome for the future of the UK mobile industry, arguing that a combined Vodafone and Three could make more efficient investments and push BT and Virgin Media O2 to improve their services, enhancing the market's long-term connectivity.

The final decision on the Vodafone-Three merger is expected in December and could significantly reshape the landscape of mobile services in the UK.

Technology News

Zaker Adham

09 November 2024

Technology News

Zaker Adham

09 November 2024

Technology News

Zaker Adham

09 November 2024

Technology News

Zaker Adham

07 November 2024