Unprecedented Bidding War Erupts Over Anysphere, Creator of Popular AI Coding Assistant Cursor

Technology News

Zaker Adham

09 November 2024

02 October 2024

|

Zaker Adham

Summary

Summary

Switzerland’s stock market ended on a weaker note Monday, influenced by global concerns and geopolitical tensions. However, despite these challenges, the outlook for the manufacturing and financial services sectors remains positive. This brings attention to high-growth tech stocks in Switzerland that are positioned to thrive, even amidst fluctuating market conditions. Investors looking to tap into Switzerland's tech scene may find significant opportunities in several top-performing companies.

Here's a glimpse of the top 10 tech stocks in Switzerland based on their revenue and earnings growth:

| Company Name | Revenue Growth | Earnings Growth | Growth Rating |

| Santhera Pharmaceuticals Holding | 26.80% | 35.40% | ★★★★★★ |

| LEM Holding | 8.69% | 18.43% | ★★★★☆☆ |

| ALSO Holding | 12.69% | 24.49% | ★★★★☆☆ |

| Temenos | 7.60% | 14.32% | ★★★★☆☆ |

| Comet Holding | 19.66% | 47.84% | ★★★★★☆ |

| Cicor Technologies | 7.10% | 27.73% | ★★★★☆☆ |

| SoftwareONE Holding | 8.63% | 52.57% | ★★★★★☆ |

| Basilea Pharmaceutica | 9.24% | 34.42% | ★★★★★☆ |

| Kudelski | 13.22% | 121.68% | ★★★★☆☆ |

| Sensirion Holding | 13.76% | 104.68% | ★★★★☆☆ |

These companies represent some of the best opportunities for investors seeking growth in Switzerland's tech industry. For a comprehensive list of all high-growth tech and AI stocks, check out our complete SIX Swiss Exchange screener.

Comet Holding (SWX)

Growth Rating: ★★★★★☆

Comet Holding AG is a global leader in X-ray and RF power technology, with a market capitalization of CHF2.59 billion. Operating across three main divisions—X-Ray Systems, Industrial X-Ray Modules, and Plasma Control Technologies—Comet has consistently shown resilience despite market challenges. Its R&D efforts are paying off, with a projected 19.7% annual revenue growth, well above the Swiss market average. The company’s strong financial performance in the first half of the year, highlighted by a 47.8% surge in earnings, further cements its position as a tech leader in Switzerland.

Sensirion Holding (SWX)

Growth Rating: ★★★★☆☆

Sensirion Holding AG specializes in sensor systems and components, serving clients globally. Despite reporting a recent net loss of CHF36.01 million, Sensirion is poised for recovery, with expected annual revenue growth of 13.8%. The company’s innovative drive, backed by substantial R&D investments, is projected to yield a 104.7% earnings growth over the coming years, positioning Sensirion as a strong contender in Switzerland’s tech industry.

Temenos (SWX)

Growth Rating: ★★★★☆☆

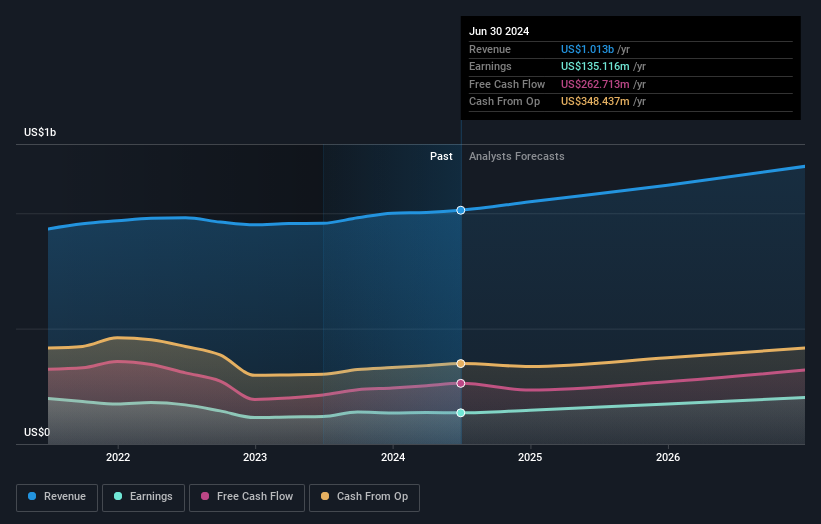

Temenos AG is a major player in banking software solutions, with a market cap of CHF4.32 billion. The company has consistently expanded its footprint in the global market, with recent earnings reports indicating revenue growth from $238.97 million to $248.39 million. Temenos is focusing on increasing its presence in the U.S. market and is expected to grow earnings by 14.3% annually. The company’s aggressive share buyback program demonstrates confidence in its strategic direction and financial stability.

Technology News

Zaker Adham

09 November 2024

Technology News

Zaker Adham

09 November 2024

Technology News

Zaker Adham

09 November 2024

Technology News

Zaker Adham

07 November 2024