Technology News

What Is Credit Karma and Why You Should Be Cautious

04 October 2024

|

Zaker Adham

Credit Karma, founded in 2007, is a company now owned by Intuit, the same powerhouse behind TurboTax and QuickBooks. The platform is best known for providing users with free access to their credit scores and reports. While it claims to champion “financial progress for all,” there’s a significant caveat—Credit Karma often nudges its users toward accumulating more debt, such as credit cards and loans.

What Does Credit Karma Offer?

Credit Karma offers a range of services beyond credit score access. Users can monitor their credit, get insights into what influences their score, and receive personalized recommendations to improve it. However, these recommendations typically involve taking on more debt, whether it's through personal loans, auto loans, or credit cards.

While it's important to stay on top of your credit health, be wary of getting drawn into a cycle of borrowing just to boost your credit score. Essentially, Credit Karma's business model profits by promoting debt products, which can be dangerous for individuals already struggling financially.

Transition from Mint to Credit Karma: What You Need to Know

As of March 23, 2024, Mint users will no longer be able to access their budgeting accounts. Instead, they’ll be encouraged to move their financial data to Credit Karma. However, users won't have the same budgeting features that Mint offered. While Credit Karma allows tracking of transactions and net worth, it doesn’t offer robust budgeting tools.

For those worried about their financial data, Mint users can transfer a majority of their account balances and three years of transactions to Credit Karma. However, you may want to download a complete history of your transactions before making the move.

How Does Credit Karma Work?

After downloading the app and creating an account, users can check their credit scores from TransUnion and Equifax. These scores are presented as a snapshot of your current credit health. However, the service frequently suggests offers for credit cards and loans, aimed at improving your credit score but also increasing your debt load.

Credit Karma’s VantageScore 3.0 model, while accurate, might differ slightly from the more widely known FICO score, which is used by many lenders. The exact numbers might vary, but the score range remains similar—whether it's poor, fair, good, or excellent.

Is Credit Karma Safe?

Credit Karma uses 128-bit encryption to keep your personal information secure. However, their constant promotion of debt makes it less "safe" financially. The more debt you take on, the more likely you are to fall behind on payments and potentially damage your financial health.

Credit Karma claims not to sell your personal data to third parties, but it doesn’t need to. It makes money by pushing you toward its own debt products. This means every time you accept a loan or credit card offer, Credit Karma profits.

Does Using Credit Karma Affect Your Credit?

Checking your credit score through Credit Karma doesn’t impact your credit directly. However, applying for credit cards or loans they recommend does. Each time a lender checks your credit report, a hard inquiry is added, which can slightly lower your score. Credit Karma's Approval Odds feature is designed to show you which credit products you're more likely to be approved for, but it has been criticized for misleading consumers in the past.

In 2022, the Federal Trade Commission ordered Credit Karma to pay $3 million to consumers for falsely advertising credit card approvals. This shows that while Credit Karma’s services can be useful, they’re not always transparent or reliable.

Alternatives to Credit Karma

While Credit Karma provides useful insights, it's not the only option for keeping track of your credit. Instead, you can request a free annual credit report from the major bureaus—Equifax, Experian, and TransUnion—without being bombarded by loan and credit card offers.

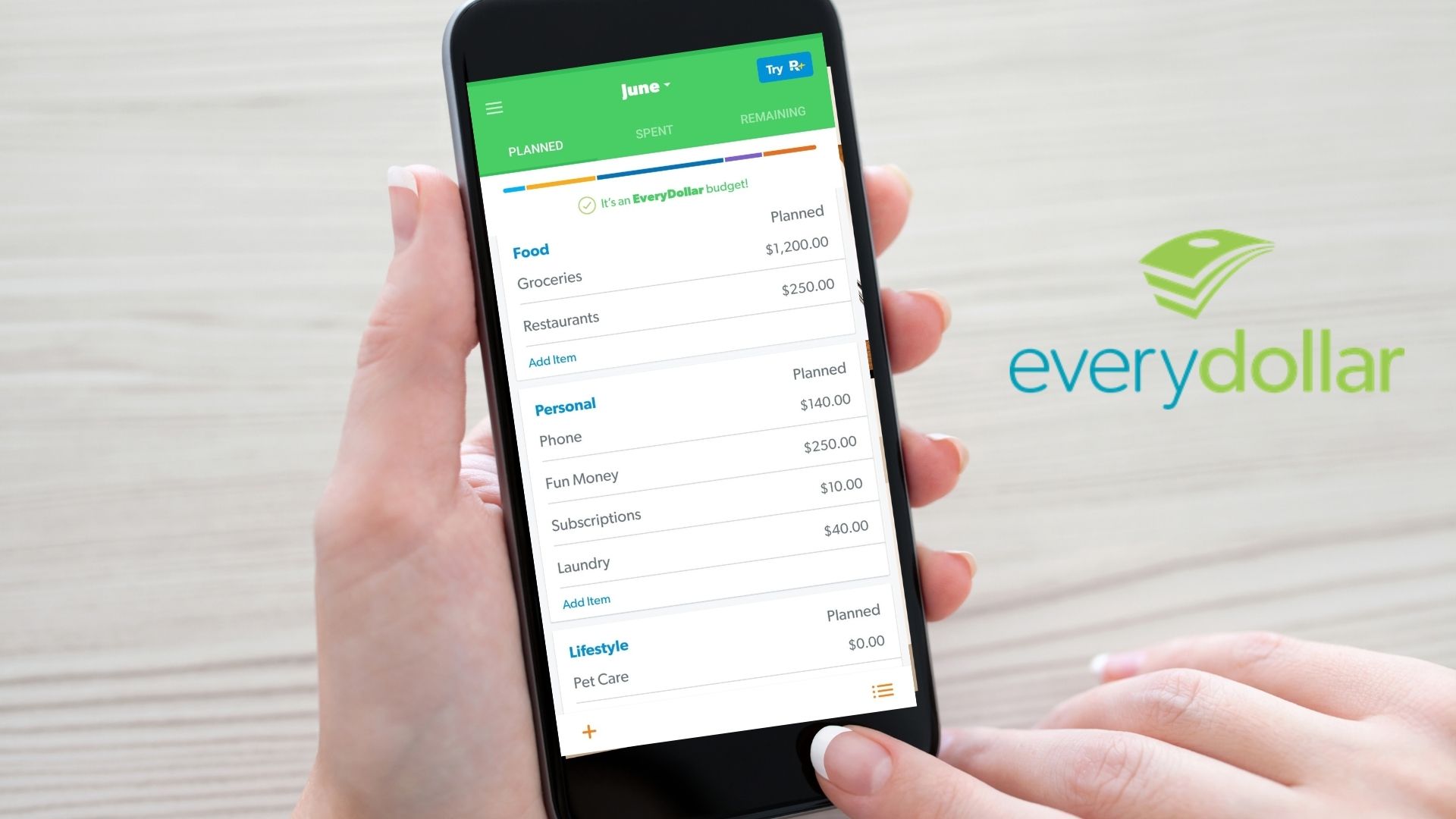

If you’re more interested in managing your finances rather than just improving your credit score, consider switching to an app like EveryDollar. Unlike Credit Karma, EveryDollar focuses on creating a budget and helping you manage your money without encouraging debt. It's a more reliable tool for staying on top of your finances and achieving financial freedom.