China Stocks See Best Trading Day Since 2008 Amid Stimulus Surge

Stocks

Zaker Adham

30 September 2024

21 August 2024

|

Zaker Adham

Summary

Summary

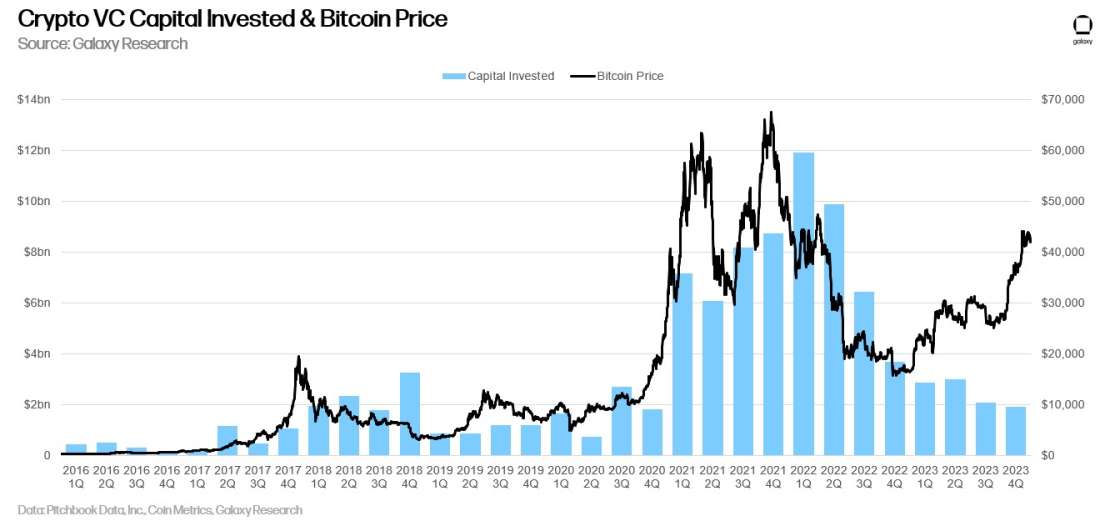

Crypto venture capital funding saw a modest increase of 2.5% in the second quarter of 2024, reaching $2.7 billion, according to Pitchbook data. Despite a dip in the total number of deals, this uptick in funding reflects growing confidence from institutional investors in the crypto market.

In parallel, the Tron blockchain network has achieved a significant milestone by surpassing Ethereum in revenue over the past 90 days. Tron generated approximately $435 million in fees, outpacing Ethereum's $364 million during the same period. This impressive performance positions Tron to potentially surpass $2 billion in revenue by the end of 2024, which could make it the most profitable blockchain worldwide, according to Tron founder Justin Sun.

Crypto Startup Funding Grows Amidst Fewer Deals Pitchbook's August 9th report revealed that although the total number of crypto investment deals decreased by 12.5% compared to the first quarter, the amount of capital invested rose by 2.5%. This suggests that while fewer deals were made, they involved larger sums, indicating sustained interest and trust in the crypto sector from institutional investors.

Tron Outperforms Ethereum in Revenue The Tron network has demonstrated robust growth by surpassing Ethereum's revenue over the past 90 days. With $435 million in fees generated, Tron outstripped Ethereum's $364 million, marking a 50% higher revenue in just 30 days. Justin Sun, the founder of Tron, shared his optimistic outlook for the network, suggesting that Tron is on track to become the most profitable blockchain by the end of the year.

Vessel's $10M Seed Round to Advance ZK-Powered DeFi Solutions Vessel, a new decentralized finance (DeFi) project, has secured $10 million in seed funding from prominent Web3 investors. The project aims to develop a layer-3 solution for DeFi, leveraging zero-knowledge (ZK) technologies to tackle challenges like liquidity fragmentation and cross-chain compatibility. The project’s launch of its mainnet marks a significant step toward enhancing the efficiency and transparency of DeFi platforms.

Coinbase Challenges SEC's Exchange Definition In a new letter to the United States Securities and Exchange Commission (SEC), Coinbase has critiqued the agency's proposed changes to the definitions of a national securities exchange. This marks Coinbase's third response, focusing on the SEC's flawed cost-benefit analysis. Coinbase Chief Legal Officer Paul Grewal argues that the SEC should withdraw its current proposal and conduct a more thorough analysis before moving forward.

Ethereum's Supply Surpasses 120 Million ETH Amid Staking Surge Ethereum, the leading open-source blockchain platform, has surpassed the 120 million ETH supply mark. This milestone comes as staking and restaking of Ether (ETH) gain traction, bolstering the network's proof-of-stake consensus mechanism. According to Ultrasound.money, Ethereum issued 77,091 ETH over the last 30 days, bringing the total supply to approximately 120.28 million ETH.

DeFi Market Overview The decentralized finance (DeFi) market faced another challenging week, with most of the top 100 cryptocurrencies by market capitalization ending in the red for the second consecutive week. Solana-based memecoin Dogwifhat (WIF) and the Brett (BRETT) token were among the biggest losers, with declines of over 20% and 17%, respectively.

Stocks

Zaker Adham

30 September 2024

Stocks

Zaker Adham

30 September 2024

Stocks

Zaker Adham

30 September 2024

Stocks

Zaker Adham

27 September 2024