Binance Derivatives Market Share Drops to 2020 Levels Amid CEX Trading Slowdown

Business Intelligence (BI)

Zaker Adham

04 October 2024

13 July 2024

|

Zaker Adham

Summary

Summary

On Friday, the Dow Jones Industrial Average soared, closing above 40,000 for the first time since mid-May as stocks rallied broadly, driven by increasing expectations of rate cuts.

New economic data showed a slowdown in consumer inflation and only a slight rise in producer prices, which fueled market optimism.

Market Highlights:

Economic Indicators: The rally was bolstered by data suggesting a potential rate cut in September. Consumer prices rose less than expected, while wholesale inflation increased only slightly. According to the CME FedWatch Tool, there is nearly a 90% chance that the Federal Reserve will reduce interest rates at the September FOMC meeting. Traders are also predicting a significant rate cut of 50 basis points at the December meeting, with the fed funds rate potentially dropping to 4.50%-4.75%.

Market Close Data:

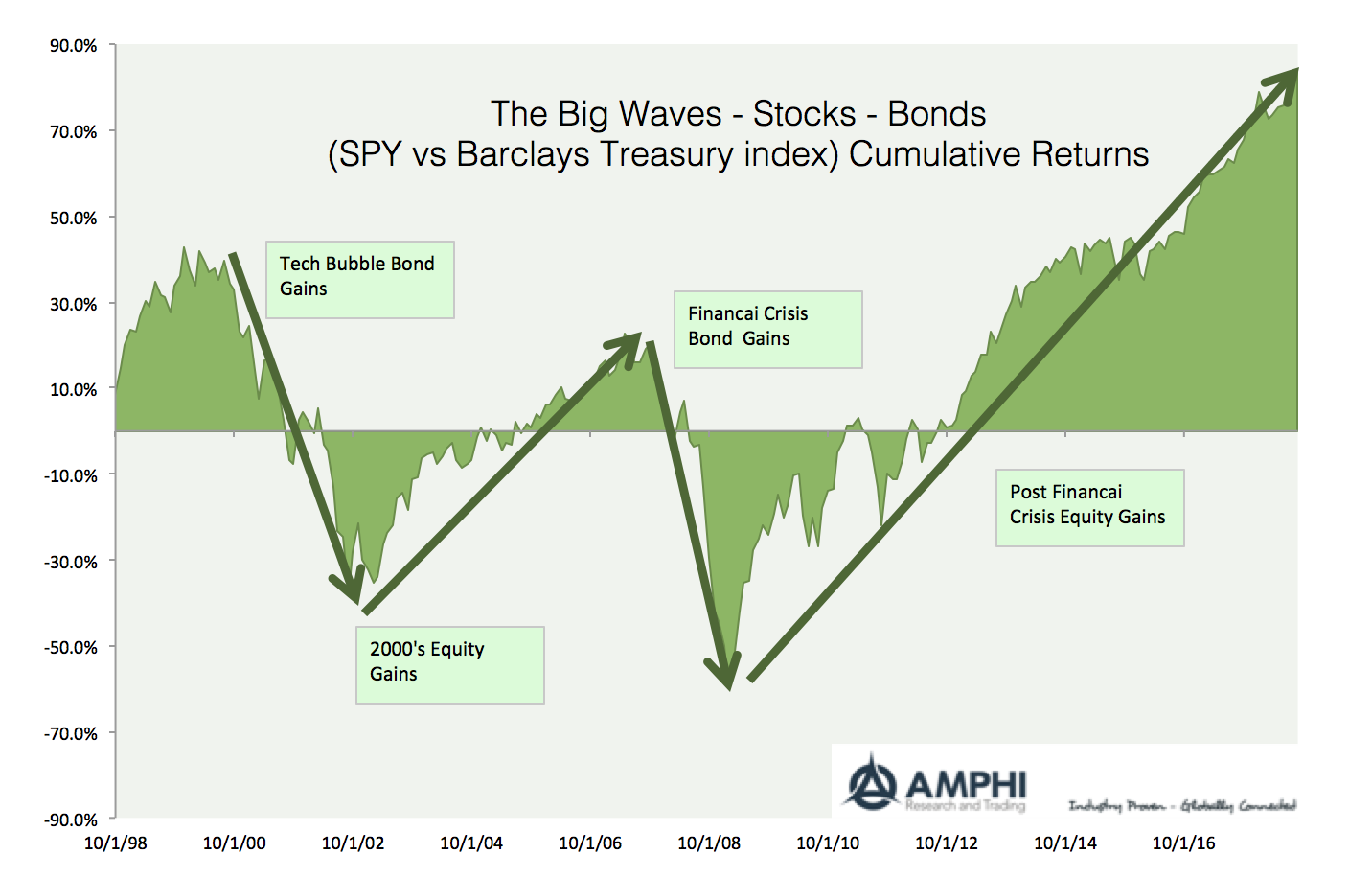

Bond Market Reaction: Bond yields have fallen as the market adjusts to the favorable economic data. The two-year Treasury note yield decreased by approximately 14 basis points over the past week, and the 10-year bond yield dropped by over eight basis points, falling to 4.182% on Friday.

Investor Sentiment: As the outlook for interest rates becomes clearer, investors are optimistic about stocks previously hindered by tighter Federal Reserve policies. This shift eases concerns about market concentration in tech giants like Nvidia.

Additional Market Updates:

Commodities, Bonds, and Crypto:

Business Intelligence (BI)

Zaker Adham

04 October 2024

Business Intelligence (BI)

Zaker Adham

25 September 2024

Business Intelligence (BI)

Zaker Adham

25 September 2024

Business Intelligence (BI)

Zaker Adham

12 September 2024